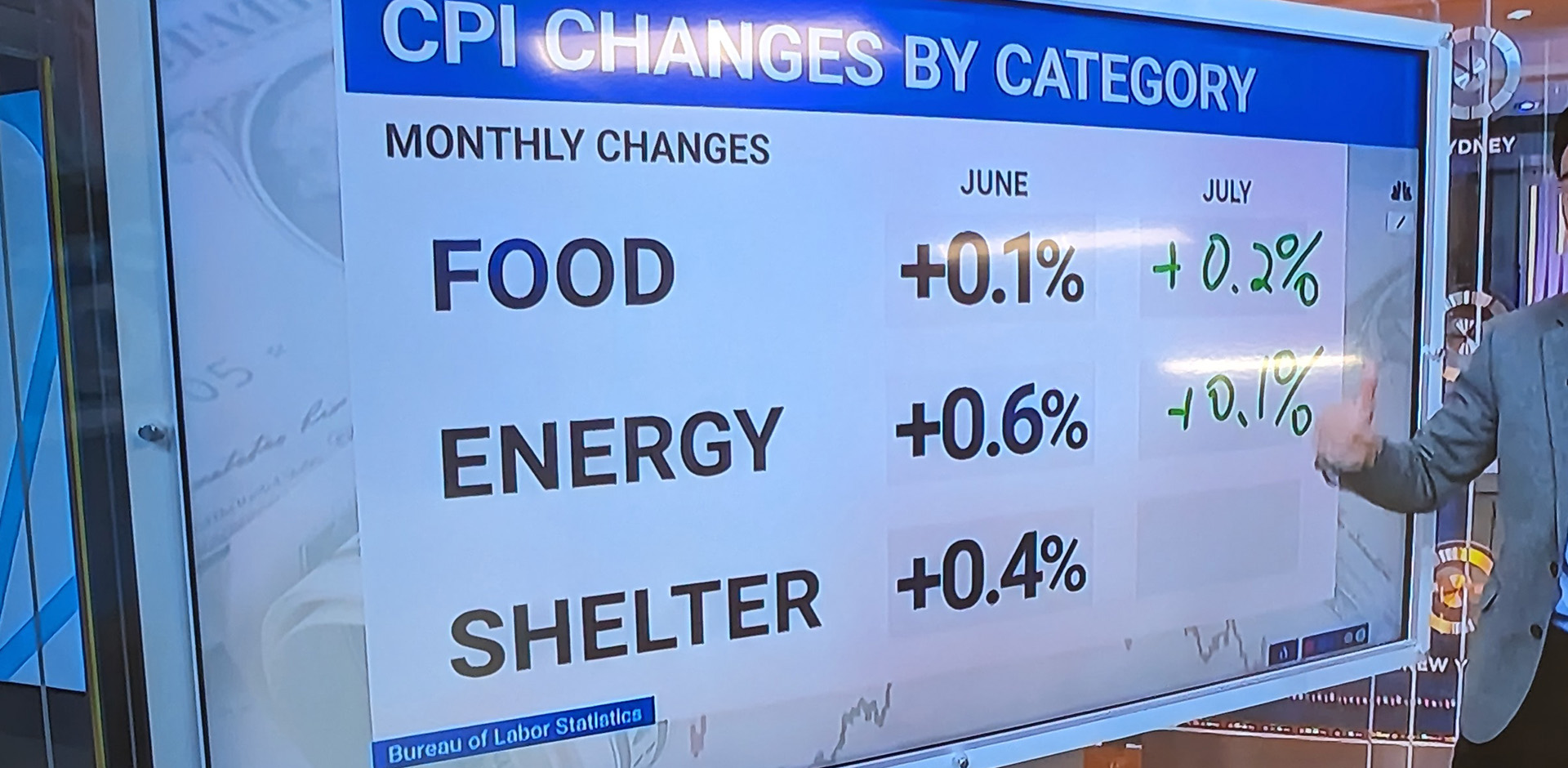

Inflation, gas, and food prices all continued to rise in the United States on August 10, 2023. The Consumer Price Index (CPI), which measures inflation, rose 8.6% in the year ending in June, the highest rate since 1981. Gas prices averaged $4.72 per gallon, up 56% from a year ago. And food prices rose 10.4%, the largest 12-month increase since 1981.

The rising prices are putting a strain on household budgets and businesses. Consumers are paying more for everything from groceries to gas to rent. Businesses are facing higher costs for raw materials and labor, which is leading to higher prices for goods and services.

The Federal Reserve is expected to raise interest rates several times this year in an effort to cool the economy and bring inflation under control. However, it is unclear how effective these measures will be. Some economists believe that the Fed may need to raise rates more aggressively in order to bring inflation down.

The rising prices are also a concern for the Biden administration. President Biden has blamed the previous administration for the inflation crisis, but he has also taken some steps to address the problem. He has released oil from the Strategic Petroleum Reserve in an effort to lower gas prices, and he has proposed a plan to provide tax relief to families.

It is still too early to say how long the inflation crisis will last. However, it is clear that it is having a significant impact on the US economy. Consumers are feeling the pinch, businesses are facing higher costs, and the Federal Reserve is under pressure to act.

Here are some tips for dealing with the rising prices:

- Shop around for the best deals. There is a lot of variation in prices for groceries, gas, and other goods and services. Take some time to compare prices before you make a purchase.

- Use coupons and discounts. There are a lot of coupons and discounts available online and in stores. Take advantage of these offers to save money.

- Cook at home more often. Eating out is more expensive than cooking at home. If you can, try to cook more meals at home.

- Walk or bike instead of driving. Gas prices are high, so it can save you money to walk or bike instead of driving.

- Take public transportation. If you live in a city with public transportation, consider using it instead of driving.

It is also important to remember that the inflation crisis is not permanent. The Federal Reserve is taking steps to address the problem, and prices are likely to start coming down eventually. In the meantime, there are things you can do to reduce the impact of rising prices on your budget.